Welshpool Commercial Real Estate: Lease Guide

Learn about commercial real estate in Belmont and the properties for lease in Perth’s most central industrial area. Read our guide to leasing in Belmont.

We’re pleased to share our latest market update for commercial properties in Perth’s South‑East suburbs, including Belmont, Welshpool, Kewdale, Victoria Park, Cannington, Ascot, and Burswood.

With over 35 years of experience in Perth’s south-east commercial property market, we’ve helped clients navigate every type of market condition. Whether it’s leasing, sales, or ongoing support, our team of specialist property managers is always in the know. In this mid-year update, our team draws on that extensive experience to give you a practical, suburb-by-suburb look at how the market is tracking across Belmont, Welshpool, Kewdale, and beyond.

This update follows on from a previous article we wrote, “Which Commercial Property Investment Will Perform Best in 2025”, where we identified industrial property as a standout performer. In this article, we take another look at that view using the latest market data to provide a practical assessment of how things are tracking and where the market may be heading next.

The first quarter of 2025 has delivered strong signals across Perth’s commercial property sectors, with continued growth in industrial and surprising momentum in both office and retail. While end-of-financial-year data is still pending, early figures provide valuable insights into how commercial markets are tracking across the city, especially within Perth’s South-East corridor. Below, we’ve highlighted the key trends shaping the market to date.

Retail led the city in price growth:

Industrial remains strong:

Office is recovering:

Suburb Spotlights

As specialists in Perth’s south-east commercial market, we’re on the ground every day tracking how individual suburbs are performing. Operating in a variety of commercial zones, including Belmont, Welshpool, Kewdale, Victoria Park, Cannington, Ascot, and Burswood, we’ve seen each area follow its own trends, challenges, and opportunities. Here’s what we’ve observed so far in 2025 across the key suburbs we service.

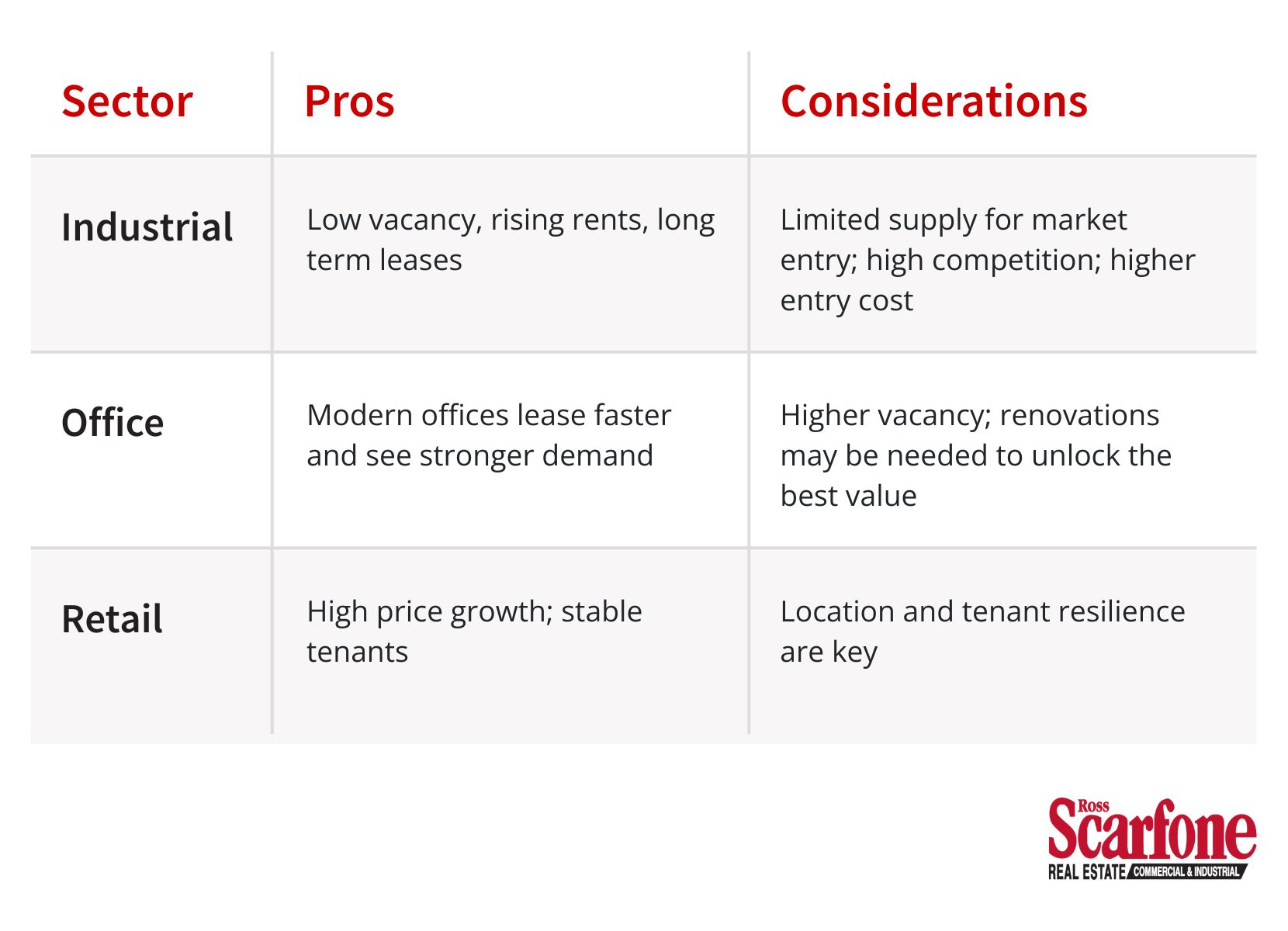

Industrial: Still the strongest performer. Supply is tight, vacancy is low, and price and rent are rising. Developers have been facing lead time delays and investors are leaning towards secure long-term returns.

Office: Gaining traction following from weaker years. Though vacancy is high, the office revival is underway in southeast fringe precincts. Owner occupiers are leading the demand.

Retail: Surging price growth in select South-East suburbs. Occupier stability and easy customer access are fuelling value. There are great retail opportunities in Belmont and Cannington.

Expert Tip: Location matters. A warehouse in Welshpool or Kewdale, a well-located office in Burswood, or a retail space in Belmont could outperform broader metro averages.

Moving into the 25/26 Financial Year, confidence in Perth’s commercial property market remains steady, particularly across the South-East corridor, where infrastructure, transport access, and growing local demand continue to shape investor activity.

Industrial land shortages aren’t going away anytime soon, keeping upward pressure on pricing, especially for modern, high-clearance warehouses and well-positioned logistics facilities. For developers, navigating zoning approvals and lead-time delays will be a defining challenge, and for investors, this translates into fewer quality assets coming to market, but stronger rental competition when they do.

Office spaces are seeing a shift in how businesses choose where and how to operate. Many SMEs and professional service firms are stepping back from the CBD and settling into well-connected suburban areas where fit-out costs are lower, and car access is easier for staff and clients alike. If this decentralisation trend continues, there could be strong upside for fringe office assets, especially those that offer flexibility, character, or scope for upgrades.

Retail is where we expect to see the most variance. Investor success in this category will depend heavily on tenant selection, lease security, and location quality. With population growth continuing and more people living, working and shopping locally, demand for suburban retail is expected to rise, especially in neighbourhoods with solid transport links and growing household density. Centres anchored by medical, food, and essential services tend to perform best and will remain on the radar for savvy buyers.

Looking forward, the fundamentals remain strong. Perth continues to benefit from a resilient local economy, expanding infrastructure, and sustained demand for commercial space across key sectors. Whether you’re planning to buy, lease, or expand your portfolio, now is a good time to refine your strategy and align with professionals who know this market inside and out.

Our family-run business has 35 years’ experience guiding investors through changing market cycles. With our boots firmly on the ground and unmatched local knowledge, we’re here to help you make the right move, whatever the next 12 months bring

Across all asset classes, we believe that active and responsive property management will become even more important. Tenants today expect more – from maintenance responsiveness to clear communication and flexibility around lease terms. If you’re holding or planning to purchase commercial property in Perth’s south-east, having the right team managing your asset can be the difference between stable returns and missed opportunities.

From January through to July 2025, Perth’s South-East commercial market shows clear trends:

Where to go from here?

If you’re aiming for secure cash flow and steady growth, industrial remains top tier. But smart bets in office or retail, tailored to location and tenant mix, can also pay off.

Contact us today for expert help and guidance navigating Perth’s South-East Markets.

The data and insights in this article are based on the latest available reports and industry research as of June 2025. Key sources include:

Learn about commercial real estate in Belmont and the properties for lease in Perth’s most central industrial area. Read our guide to leasing in Belmont.

When purchasing commercial or industrial property in WA, it’s important to understand what stamp duty is, what rate of duty will apply to a given transaction, and what it means for your circumstance.

Which property type should you invest in for 2025? View our past and present analysis of the office, retail and industrial property sectors paired with insight from expert 2025 predictions.